From Our Chairman

While equity markets have been volatile over the past year and a half, we may well look back to this year as an inflexion point across several global fronts.

Economically, concerns about premature policy tightening and its implications for global growth gave way to escalating tensions, particularly between the US and China. While the increasingly challenging global environment may dampen business confidence and investment, we expect policymakers to be primed for dovish policies. The low interest rate environment is likely to persist if growth remains weak. This could lower returns expectations into the foreseeable future.

We remain watchful around the risks of a late cycle recession in the US. Brexit and political fragmentation continue to weigh on Europe, while China has yet to move fully to restructure its economy for longer term sustainability. These issues have key repercussions on global sentiments and sustainable growth for the longer term.

We owe it to future

generations to

put our planet on a

sustainable footing.

Today, climate change is the most critical challenge facing humanity. The Intergovernmental Panel on Climate Change has warned that we have until 2030 to reverse the global carbon and greenhouse gas emissions. We are already one degree warmer, with a margin of only half a degree more before we hit the tipping point of 1.5 degrees Celsius.

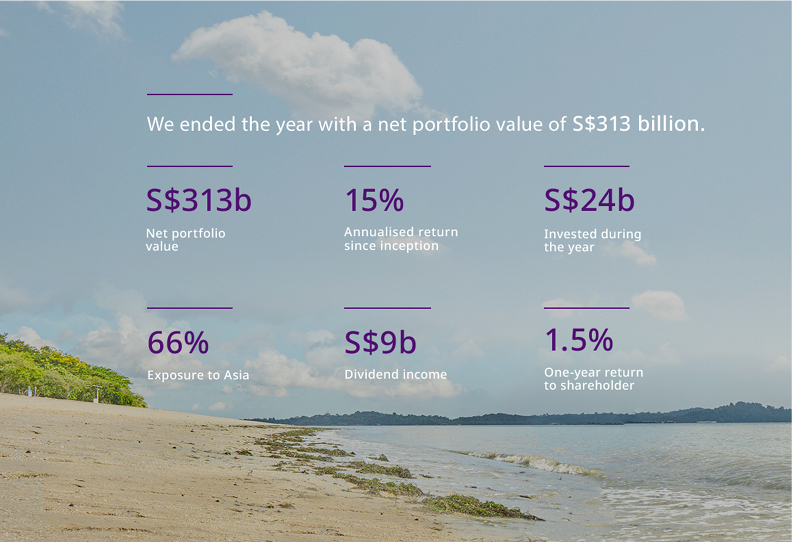

Portfolio Performance

S$313b

Net portfolio value

as at 31 March 2019

Our investment focus is driven by structural trends in transformational technologies, sustainable living, longer lifespans and changing consumption patterns.

During the year, we invested S$24 billion and divested S$28 billion, reflecting the deliberate tempering of our investment pace over the year.

As at 31 March 2019, our net portfolio value was S$313 billion.

During the year, we invested S$24 billion and divested S$28 billion, reflecting the deliberate tempering of our investment pace over the year.

As at 31 March 2019, our net portfolio value was S$313 billion.

S$24b

Invested

for the year

We delivered a one-year Total Shareholder Return (TSR) of 1.49%, with three-year TSR at 8.88%. Longer term 10-year and 20-year TSRs were 9% and 7% respectively. TSR since inception in 1974 was 15%.

Our Wealth Added was S$18 billion below our risk-adjusted cost of capital of 7% aggregated across our portfolio.

S$28b

Divested

for the year

Dividend income from our portfolio was S$9 billion.

We ended the year in a net cash position. Our cash and bank balances, together with our short term investments, were three times our S$15 billion outstanding debt.

We ended the year in a net cash position. Our cash and bank balances, together with our short term investments, were three times our S$15 billion outstanding debt.

Group Financials

We do not manage

our portfolio for

year-to-year

accounting

profitability.

Temasek adopted the International Financial Reporting Standards (IFRS), in line with Singapore’s convergence with IFRS, with effect from 2018.

This included the new IFRS 9: Financial Instruments standard, which impacts how we report the accounting profits or losses in our group financials.

IFRS 9 requires unrealised mark to market gains or losses of sub-20% investments to be accounted as profits or losses in our income statements, even when no sale has occurred. This will lead to material fluctuations in our reported profits or losses from the year-to-year paper gains or losses. We have provided additional disclosures of our Group net profit, excluding unrealised gains or losses of sub-20% investments, to facilitate comparisons with our past years’ income statements.

IFRS 9 requires unrealised mark to market gains or losses of sub-20% investments to be accounted as profits or losses in our income statements, even when no sale has occurred. This will lead to material fluctuations in our reported profits or losses from the year-to-year paper gains or losses. We have provided additional disclosures of our Group net profit, excluding unrealised gains or losses of sub-20% investments, to facilitate comparisons with our past years’ income statements.

15%

TSR since inception

To deliver sustainable value over the long term, we focus on the performance of our portfolio over the longer time horizon, and the corresponding risk-adjusted cost of capital. We do not manage for year-to-year accounting profitability.

Navigating a Complex World

Global growth has already begun to moderate. This may be worsened by the growing trade and geopolitical tensions.

The outlook in China may come under more pressure from a prolonged standoff with the US. This is mitigated by room for policy easing and awareness of macro risks. Hence, we remain optimistic on China’s trajectory in the medium term, and expect more reform efforts to transit the economy towards a more sustainable growth path.

S$9b

Dividend income

for the year

In the US, we expect the Federal Reserve to ease monetary policy in the near term as growth has already started to slow, and inflation remains below target. While this will reduce the risk of a Fed-induced recession, a slower growth trajectory may leave the economy more vulnerable to a large negative confidence shock, such as a much harder stance on China.

Growth in Europe has slowed over the past year. While the European Central Bank remains accommodative, Europe has little policy space, and will be more vulnerable to shocks.

In Singapore, activity is moderating alongside slowing global growth. There may be further downside risks from the escalation of geopolitical tensions, though Singapore may benefit from increased trade and investment into the ASEAN region. We expect certain segments of the economy, including professional, financial and technology services, to remain resilient.

We continue to share insights and best practices with our portfolio companies, through forums on reputation issues and crisis communications, and cybersecurity.

We continue to refresh and deepen our bench strength ahead of disruptive challenges and opportunities in an increasingly complex business environment. This includes initiatives in our IT backbone and cybersecurity, as well as two Agile pods in Blockchain and Artificial Intelligence.

In terms of leadership transition, Dilhan Pillay succeeded Lee Theng Kiat as Chief Executive Officer of Temasek International (TI) on 1 April this year. Theng Kiat took over from Ho Ching as Chairman of TI, and is concurrently appointed Executive Director of Temasek Holdings, to support and guide Dilhan and the management team as we continue to build Temasek as a forward looking institution.

I am confident we have a strong team in place, led by Dilhan, to take Temasek forward in the decade ahead.

In Appreciation

Temasek’s greatest asset is our people. I thank the many generations of Boards, management and staff, past and present, who have given their time and dedication to shape our common future.

I thank my colleagues on the Temasek Board for their tireless and generous contributions during the year.

We were deeply saddened by the passing of Mr Kua Hong Pak on 31 October 2018. He has been our longest serving Board Director, and was an outstanding Chairman of our Audit Committee. We will always be grateful for his unwavering dedication and guidance over many years.

On 11 February this year, we welcomed Mr Fu Chengyu to our Board.

In October last year, we issued our T2023-S$ Temasek Bond. For the first time, we enabled retail investors in Singapore to participate in the issue. We were very pleased with the take up, and welcomed over 50,000 new Singapore retail investors to our base of stakeholders.

I am thankful to our shareholder, bondholders, co-investors, partners, regulators, philanthropic organisations, and the public, for their guidance and support. We also benefitted from the wisdom of our international and regional advisors, for which I thank them.

Capital with Purpose

In June, we launched the Temasek Shophouse as our gift for social impact in Singapore and beyond. Temasek Shophouse aims to be a convenor for community collaboration and a catalyst for advancing sustainability.

We will continue to work with governments, corporate partners, non-government organisations, multilateral and regional agencies, and individuals to reduce greenhouse emissions and pollution, and invest in solutions for a more sustainable world.

Temasek is an investor, institution and steward.

Our three roles are founded upon our commitment to do well, the determination to do right, and the inspiration to do good. Ultimately, we can thrive over the long term only if our communities do well, and we do right and good for our people, institution and planet.

Everyone can make a real difference if we look with a clear eye at the world around us, think critically about the problems we are facing, and act boldly to develop and implement solutions.

Today, climate change is clearly the most urgent and critical issue confronting the global community. We owe it to future generations to take action, and put our planet on a sustainable footing. Our efforts, no matter big or small, can make a difference to shape our collective future.

Let us look, think and act – now, together.

LIM BOON HENG

Chairman

July 2019