Total Shareholder Return

We track our total returns to our shareholder over various time periods.

Total Shareholder Return (TSR) is a compounded and annualised measure, which includes dividends paid to our shareholder and excludes capital injections from our shareholder. Our TSR over short, medium, and long time periods are a snapshot of our performance.

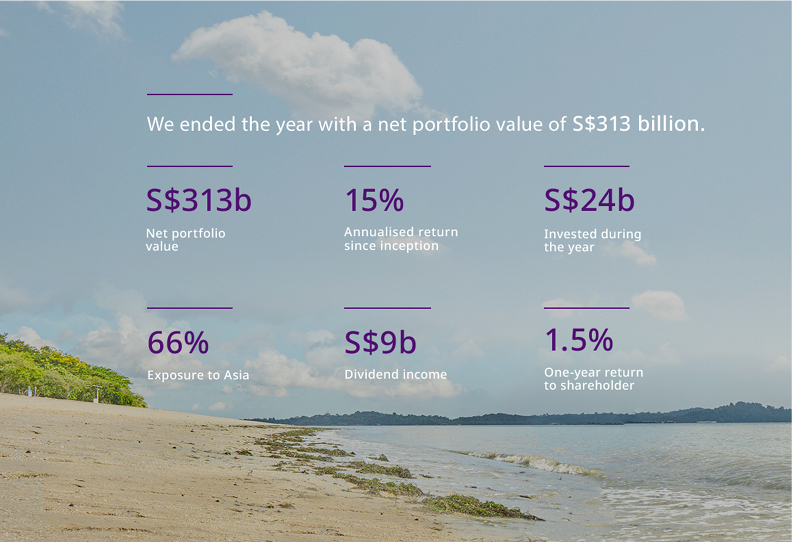

As at 31 March 2019, our Singapore dollar one-year TSR was 1.49%. Our three-year TSR was 8.88% and our 10-year TSR was 9%.

Our 20-year TSR was 7%, versus the Singapore 20-year annualised core inflation of under 2%. Longer term 40-year TSR was 15%.

Our TSR is measured against our risk-adjusted cost of capital, which is derived using a capital asset pricing model. The risk-adjusted cost of capital is built bottom-up, and aggregated over all our investments.