Credit Quality

Temasek’s Credit Profile provides a quantitative snapshot of our credit quality and the strength of our financial position.

(for year ended 31 March)

Net Portfolio

Value

over Total Debt (x)

21x

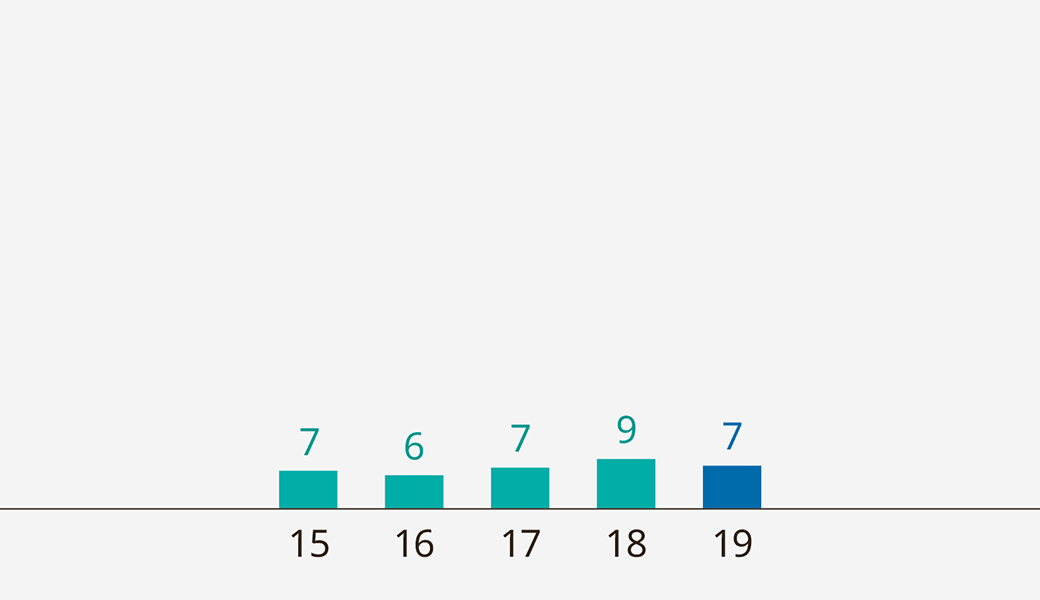

Liquid Assets

over Total Debt (x)

7x

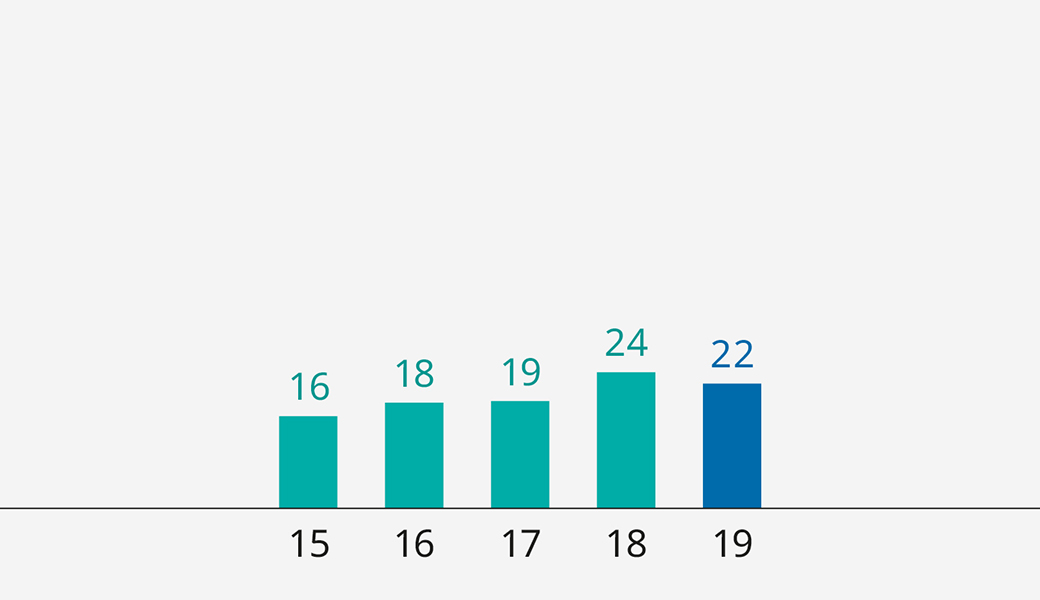

Dividend Incomeover Interest Expense (x)

22x

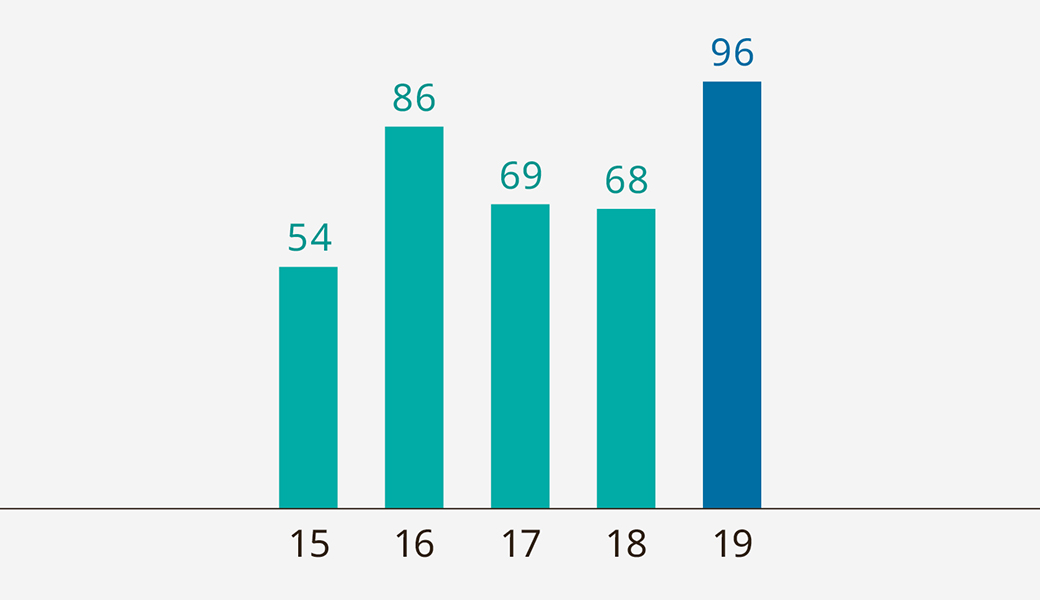

Recurring Income

over Interest Expense (x)

96x

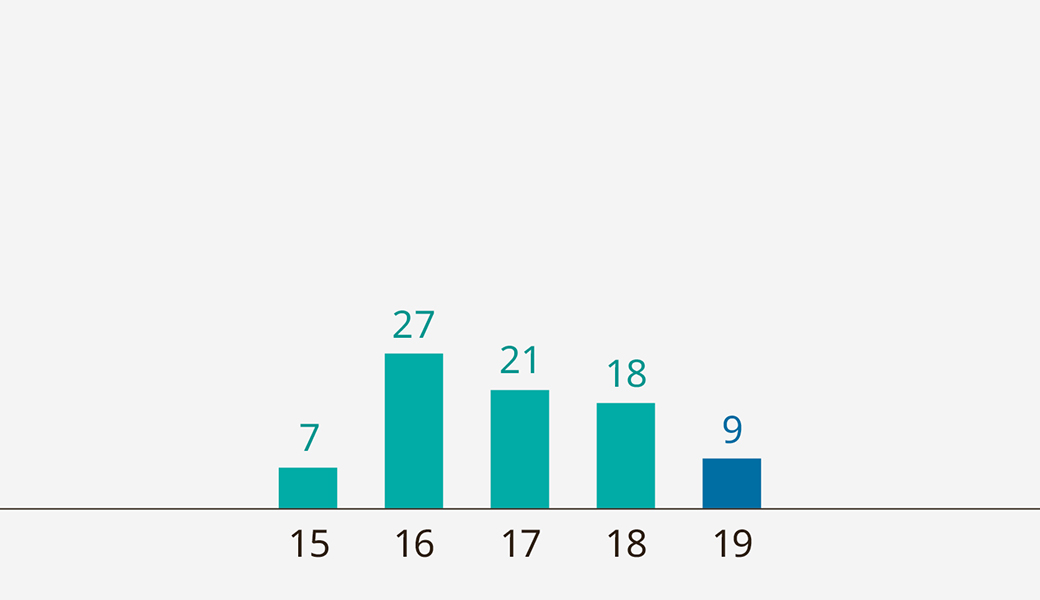

Recurring Income

over Total Debt due in One Year (x)

9x

Liquidity Balance

over Total Debt due in next 10 Years (x)

4x

As an investment company, our dividend income and divestment proceeds are used to pay our business expenses, interest to bond investors, dividends to our shareholder; repay bonds which are due; and make investments.

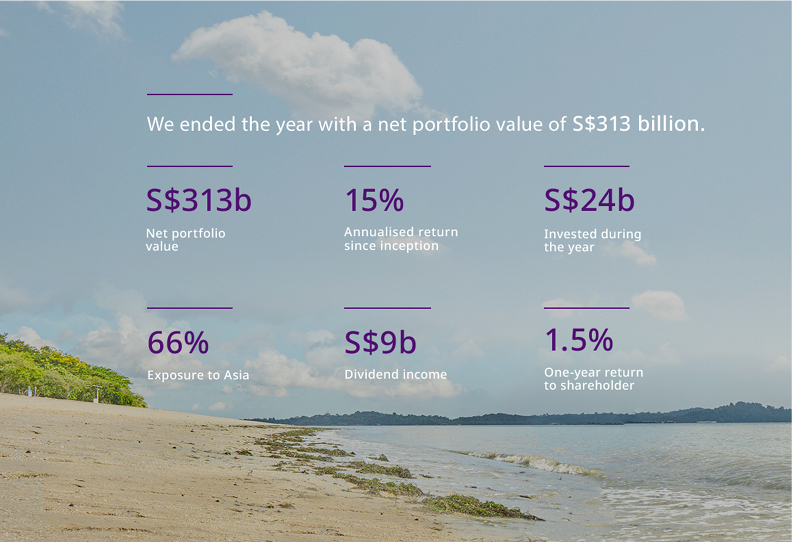

For the year ended 31 March 2019, Temasek earned S$9 billion in dividend income and divested S$28 billion. These amounts formed the bulk of our cash inflows.

Unlike pension funds or oil funds, we do not have inflows from pension contributions or oil revenues.

Our dividend income for the year ended 31 March 2019 was about 22 times our interest expense.

Temasek had S$15.1 billion of debt outstanding as at 31 March 2019.

Temasek’s cash and cash equivalents, plus short term investments, as at 31 March 2019, were three times our S$15.1 billion debt outstanding.

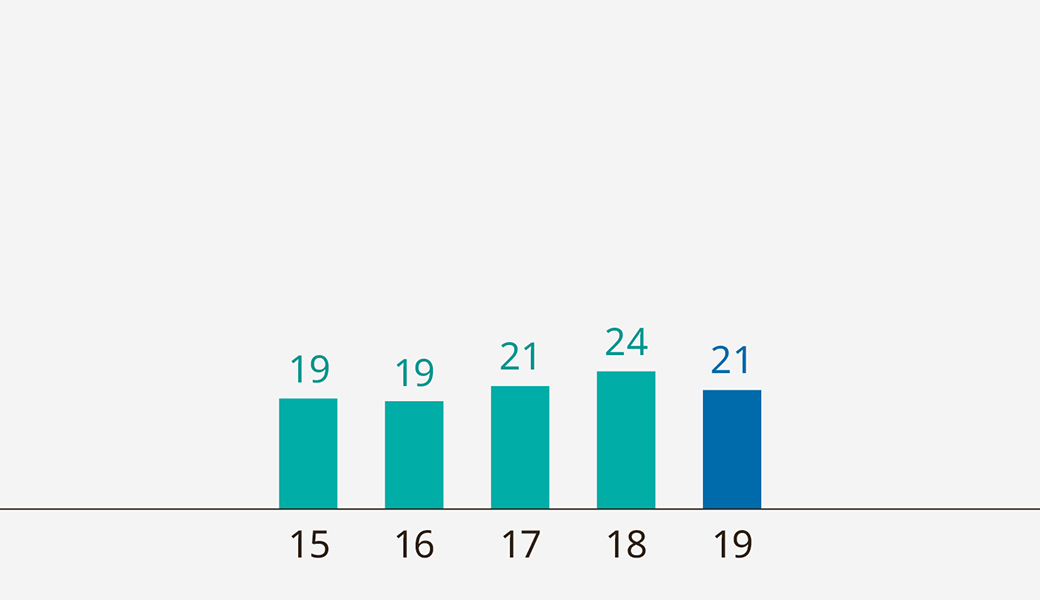

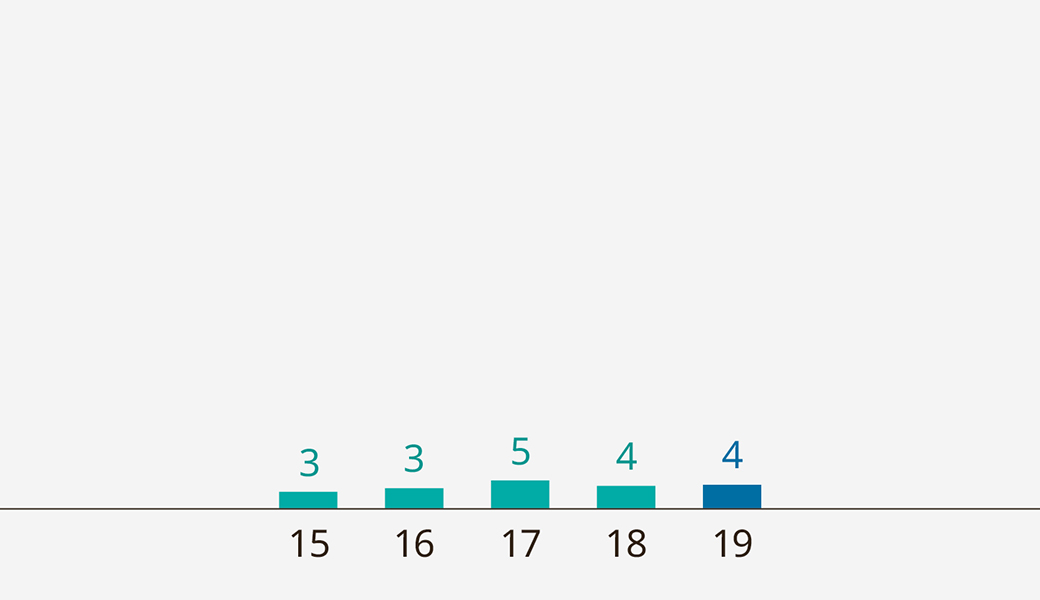

Key Credit Parameters (in S$ billion)

| For year ended 31 March | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Divestments | 19 | 28 | 18 | 16 | 28 |

| Dividend income | 7.9 | 7.8 | 7.0 | 9.0 | 8.5 |

| Income from investments | 0.1 | 0.2 | 0.2 | 0.3 | 0.4 |

| Interest income | 0.1 | 0.2 | 0.2 | 0.2 | 0.4 |

| Interest expense | 0.5 | 0.4 | 0.4 | 0.4 | 0.4 |

| Net portfolio value | 266 | 242 | 275 | 308 | 313 |

| Liquid assets | 90.6 | 74.3 | 91.1 | 110.3 | 112.2 |

| Liquidity balance | 26.7 | 27.1 | 37.6 | 33.2 | 44.2 |

| Total debt | 13.8 | 12.9 | 12.8 | 12.8 | 15.1 |