Public Markers

Our Temasek Review, Credit Profile and Temasek Bonds serve as public markers to anchor our commitment as a robust and disciplined institution through generations.

The Temasek Review is our annual scorecard to our stakeholders.

Temasek is exempted from disclosing financial information publicly, as a Singapore exempt private company. Nonetheless, we have been publishing our Temasek Review annually since 2004 as a public marker of our performance.

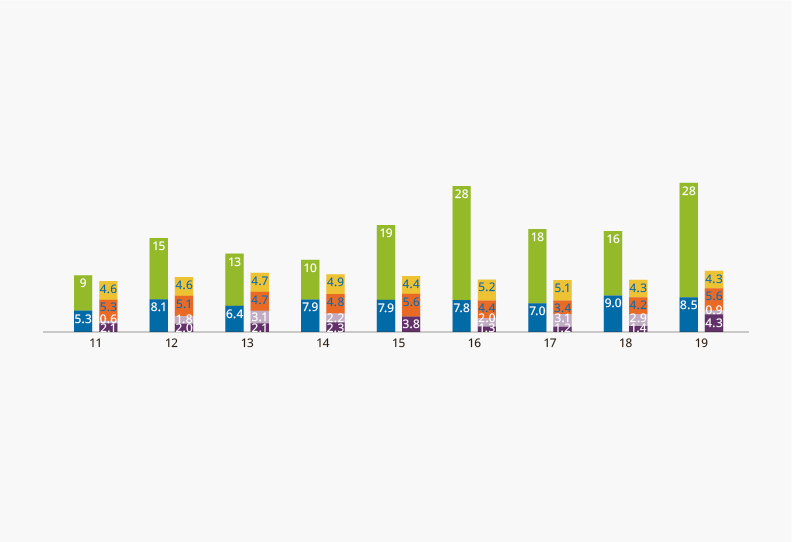

Our Credit Profile provides a snapshot of Temasek’s key credit parameters across three dimensions – leverage, interest coverage and debt service coverage. Our Credit Profile reflects the fundamental strength of our financial position as an investment company. The credit ratios facilitate a quantitative assessment of Temasek’s credit quality.

Temasek does not need to borrow or be credit rated in order to invest.

We have received the top ratings of Aaa/AAA by Moody’s Investors Service and S&P Global Ratings respectively since our inaugural ratings in 2004.

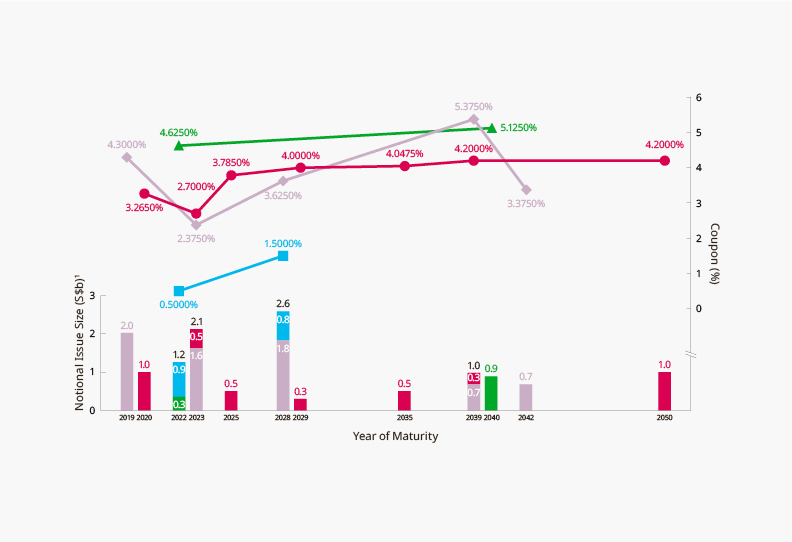

We issue Temasek Bonds and Euro-commercial Paper to retail, institutional, accredited and other specified investors as part of our financial discipline. The credit spreads in the market act like canaries in coal mines, to publicly signal market changes in Temasek’s credit quality.

Temasek does not need to borrow or be credit rated in order to invest.

Our public markers instil financial discipline, broaden our stakeholder base, and facilitate our communications with the wider community.