Investing in Bonds (Updated on 18 July 2019)

What are my risks if I invest in bonds?

All investments carry risks. This includes investments in bonds.

When you invest in a bond, you are essentially lending money to a bond issuer.

Bond investors face key risks such as market, business, legal, regulatory, interest rate, default, liquidity and inflation.

Market & Business Risks

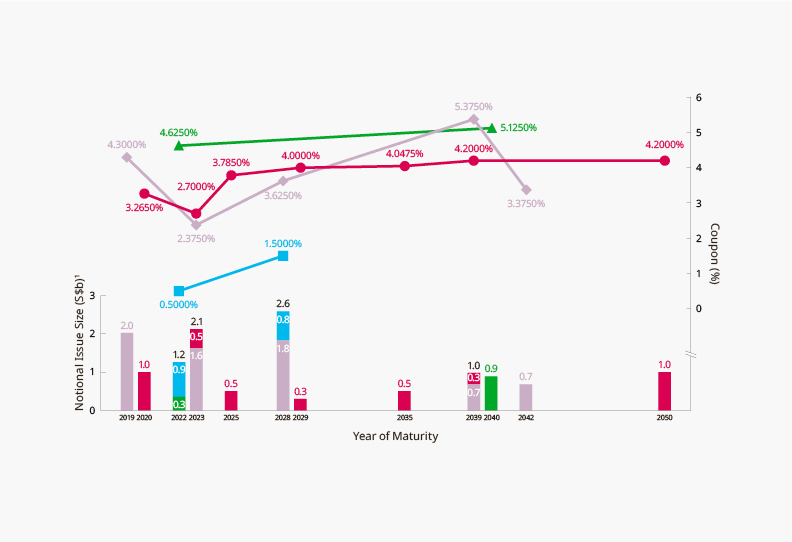

As an investment company, Temasek’s cash flows and ability to make debt repayments are dependent on the dividends and distributions from our portfolio, our divestments and our ability to borrow.

Macroeconomic, market and geopolitical conditions in major economies may impact global monetary conditions, investors’ confidence and risk appetite, as well as underlying growth prospects and global asset prices.

These could potentially have a significant impact on the value of our portfolio as well as the profitability of Temasek and our portfolio companies. In turn, these may potentially affect Temasek’s ability to meet payment obligations.

Legal & Regulatory Risks

Temasek has investments in many countries around the world.

This means Temasek and our portfolio companies could potentially face complex legal and regulatory requirements as well as regulatory or litigation action by regulators or private parties.

If any such requirements or actions result in significant costs or losses to Temasek or our portfolio companies, this could potentially impact Temasek’s financial condition and operational results.

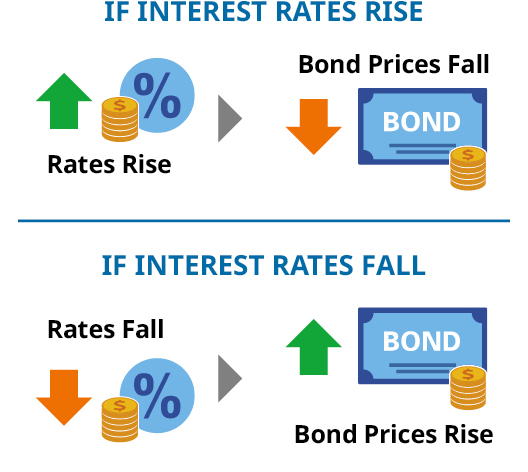

Interest Rate Risk

Market prices of a bond may rise or fall. If interest rates rise, the market price of your bond may fall, and vice versa.

Why does this happen?

If interest rates rise, bond buyers have the option of investing in new bonds issued at higher interest rates. You may have difficulty finding a buyer, unless you reduce your asking price to make it attractive to a prospective bond buyer. Hence, the market price of your bond may fall when interest rates rise.

If you wish to sell your bond before it matures, you may suffer a partial loss of your principal amount, if the market price at the time you sell is below your purchase price.

Default Risk

A default may happen when a bond issuer fails to pay the interest due, or repay the principal amount at maturity.

The default risk of each issuer is different, depending on its financial position, its debts and other obligations.

It is important to know more about the credit quality of an issuer before buying its bond.

Some issuers, or their bonds, are rated by credit rating agencies, based on their respective assessments of the quality of assets, cash flows, liquidity positions and other factors. Each agency has its own proprietary criteria for assessing credit quality.

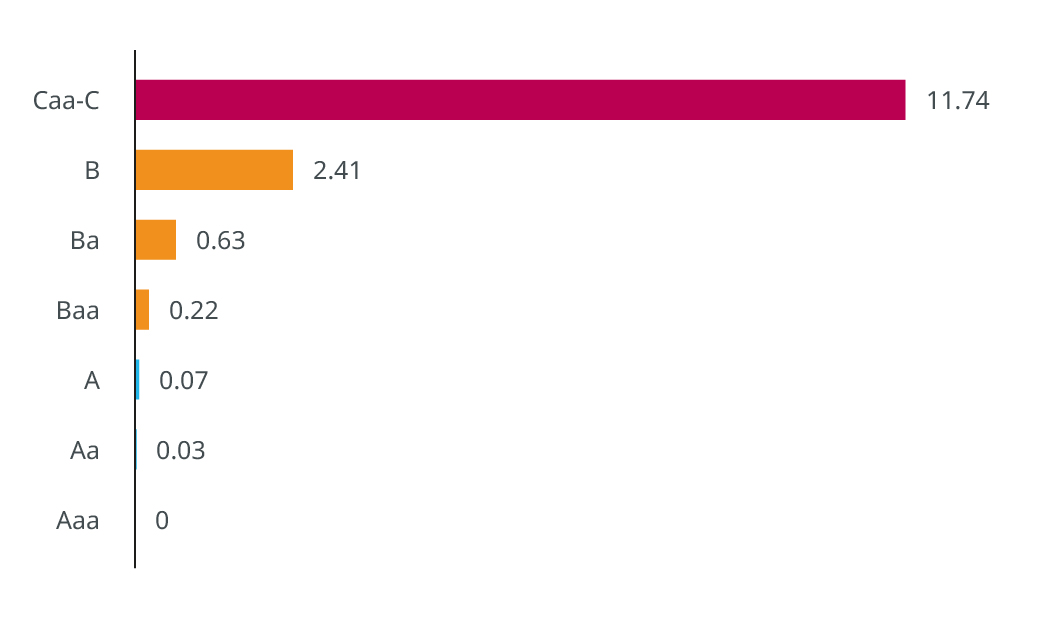

Historically, issuers with higher credit quality are less likely to default, and thus generally pay lower interest rates. Conversely, issuers with a lower credit quality are more likely to pay higher interest rates, because investors take on a higher default risk.

Average Annual Corporate Default Rates: 1999 - 2018 (%)

All Temasek Bonds are unsecured and unsubordinated obligations that are guaranteed by Temasek Holdings (Private) Limited (Guarantor). If the Guarantor becomes insolvent, holders of Temasek Bonds, as well as other equally-ranking creditors of the Guarantor, will rank equally and ahead of the Guarantor’s shareholder in terms of payment priority. Please also note that the Guarantor is an investment company that is substantially dependent on its Investment Holding Companies (IHCs) and portfolio companies for funds, and the Guarantor’s claims over assets and earnings of its IHCs and portfolio companies rank behind creditors of these companies.

Liquidity Risk

There may be very few buyers for some bonds, even if they are listed.

In a difficult market or economic situation, there may be no bond buyers at all.

You may not be able to find a buyer for your bonds in such circumstances.

Inflation Risk

Inflation means the same amount of money will buy you less goods and services over time.

As inflation rises, the fixed interest payments and the principal amount at maturity will be worth less.