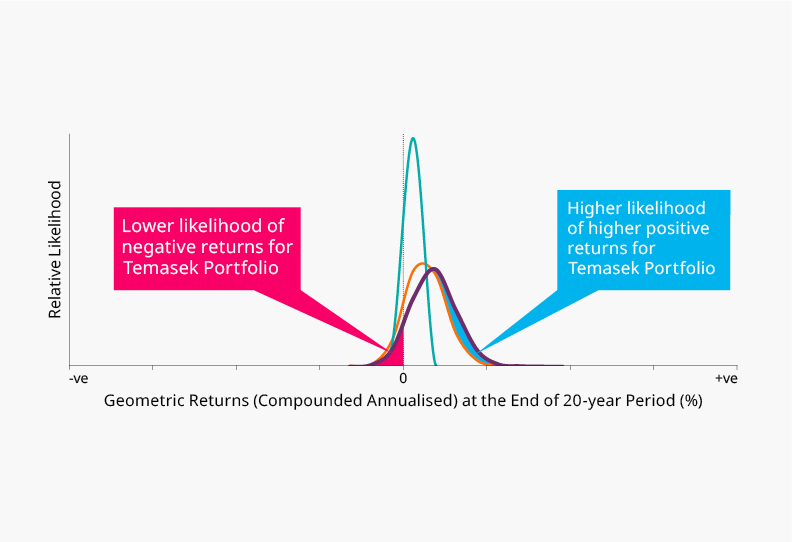

12-month Returns Outlook

We do not manage our portfolio for annual returns or profits – we share the Monte Carlo simulations of our portfolio to give our stakeholders a sense of the likely range of returns in the coming 12 months.

Applied to our current Temasek portfolio mix, our simulation shows a five-in-six chance that our one-year portfolio returns may range from -13% to +18%. Our annual returns range over -30% to +43% during the last decade or so, reflecting the volatile nature of a mostly equity portfolio.

In the chart below, narrower curves mean less volatility compared to the flatter curves of the 2008/09 Global Financial Crisis (GFC) years.

(as at 31 March)

Simulation of 12-month Forward Portfolio Returns

Volatility of Returns

A wider simulated range means a more volatile outlook.

As expected, given our portfolio concentration in equities, our analysis implies that in any given year, our net portfolio value may see a once-in-20-years swing of 30% to 40%. We saw moves of a similar magnitude during the GFC, when our net portfolio value fell 30% in one year, only to rebound 43% the next year.

The global macroeconomic environment is expected to become more challenging. In the US, we remain watchful around the risks of a late-cycle recession, which could be triggered by trade tensions, domestic shocks or geopolitical tensions. In Europe, there remains considerable uncertainty over the way Brexit unfolds, as well as concerns around political stability in Italy. We continue to closely monitor these events and take a proactive approach to managing the risks.