Instilling Ownership

Our ownership ethos puts the institution above the individual, emphasises long term over short term, and aligns employee and shareholder interests over economic cycles.

Our compensation framework aims to foster a high performing and responsible culture where our employees think and act as owners, sharing gains and pains alongside our shareholder. It balances reward for short term performance and long term value creation.

Deferred incentives and clawbacks are integral to our remuneration.

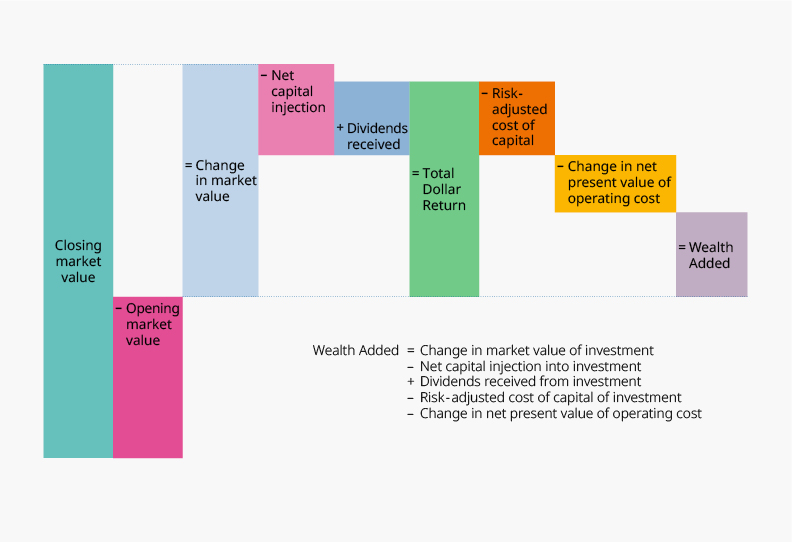

Our base salaries are benchmarked against relevant markets where we compete for talent. Short term bonuses are driven by annual targets. Returns above our risk-adjusted cost of capital determine our Wealth Added (WA) incentive pool, while negative portfolio returns determine our clawback pool. Deferred incentives and clawbacks are integral to our remuneration. Longer term incentives can be deferred up to 12 years, and are subject to market risks and clawbacks, to account for the sustainability of returns over market cycles.

Annual Cash Bonuses – Our Short Term Incentives

Annual cash bonuses are driven by company-wide, team and individual performance, and capped within budgeted limits. One of our annual performance targets requires our three-year Total Shareholder Return (TSR) to exceed our three-year cost of long term debt.

Apart from financial targets, our “Make-A-Difference” (MAD) Programme rewards employees for achieving non-financial goals targeted at strengthening the institution, contributing to their communities, and taking care of their families and themselves.

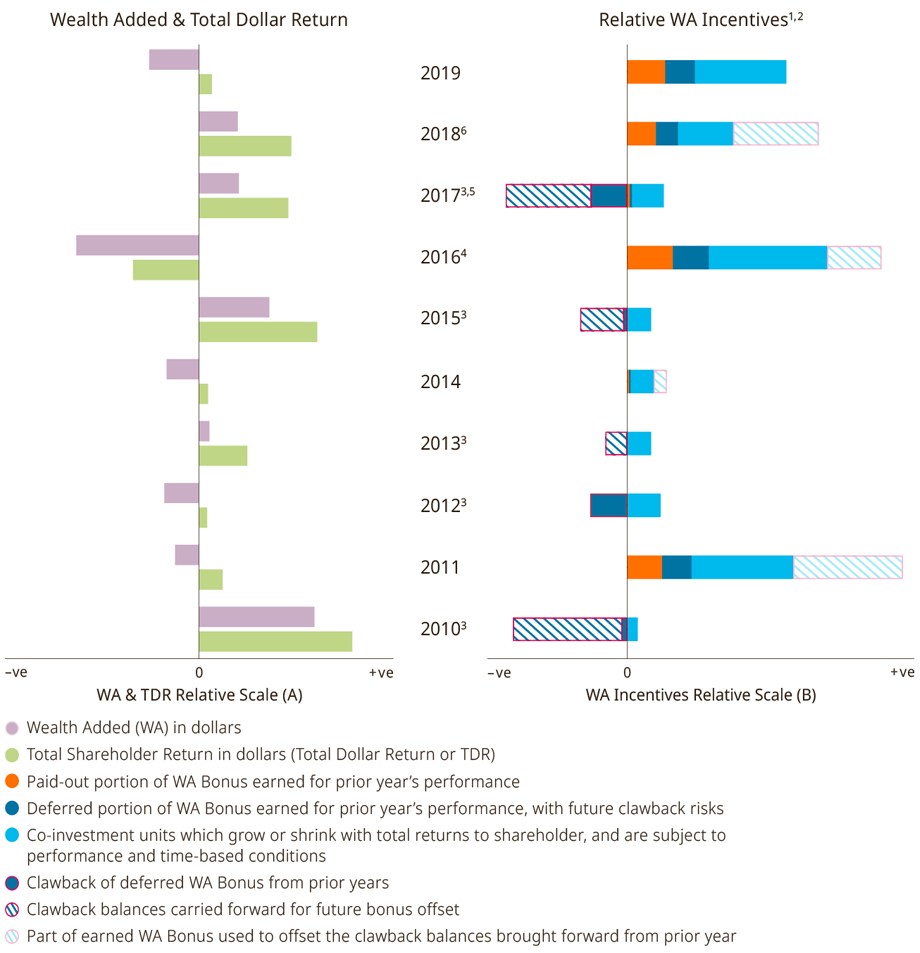

WA Bonus Bank – Our Medium Term Incentives

A portion of our WA incentive pool, whether positive or negative, is distributed into each employee’s notional WA bonus bank account, based on the individual’s performance and contributions over four years.

If WA bonus bank balances are positive, senior management receive one third payout from their balances. The corresponding payout ratios are half for mid-level management and two thirds for junior management and support staff.

Part of the retained balances are deferred as co-investment (R-Scope) grants which vest over the following three years. These units increase or decrease in value based on portfolio performance or market risk, which strengthens the alignment with medium-term risks for Temasek and its shareholder. The remaining WA bonus bank balances are subject to clawbacks in the future should returns be negative.

Co-ownership Grants – Our Long Term Incentives

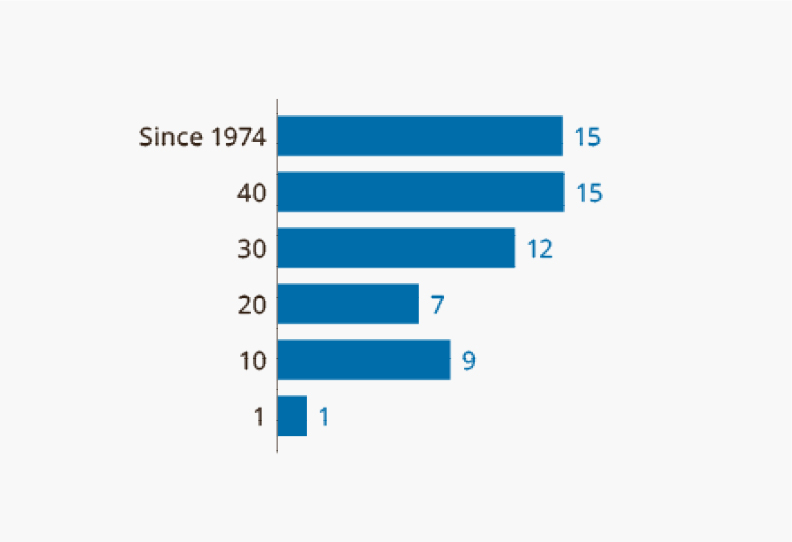

Our employees may be awarded co-investment grants with performance or time-based vesting conditions. These units grow or decline in value with our yearly TSR, reinforcing the ownership culture of our company. Co-investment units lapse after 12 years.

Part of our positive WA incentive pool funds the Temasek co-investment (T-Scope) grants, which are subject to further stringent multi-year Temasek portfolio performance conditions to trigger a five-year vesting. Another portion is held for three to seven years, as a company-wide reserve to be released progressively for time-based co-investment grants. Clawbacks, if any, will first be taken from this company-wide reserve, before being deducted from employees’ WA bonus bank accounts.

Incentives can be deferred up to 12 years and are subject to market risks and clawbacks.

Our annual operating budget funds limited time-based co-investment grants i.e. S-Scopes and Q-Scopes. They reinforce our Instilling Ownership with shareholder interest and the sustainability of our business performance over different market cycles. S-Scopes and Q-Scopes have a total vesting period of seven and 12 years respectively.

Co-ownership Alignment in Practice

As part of co-ownership alignment, clawbacks were made to our employees’ retained bonus banks when WA for prior years was negative.

In the last decade, we had five clawback pools. Of these, there were four instances we had to carry forward clawback balances, when the deferred WA incentives were not enough to clear the clawback pools from prior years.

Even with negative WA, we could continue to deliver positive portfolio returns to our shareholder.

Since 2016, clawbacks will only be applied when both WA and portfolio returns are negative.

For the year ended 31 March 2019, we will not have positive WA incentives to share. There will be no clawback on our employees’ retained bank balances.

This framework for sharing gains and the associated risks and pains through market cycles has been tested, thereby reaffirming our ownership ethos.

for year ended 31 March

WA Incentives of Key Team