Spotlight: Sustainable Living and Longer Lifespans

We are driven to look, think and act with urgency and purpose – this is part of our DNA to build a kinder, more inclusive and more sustainable future for generations to come.

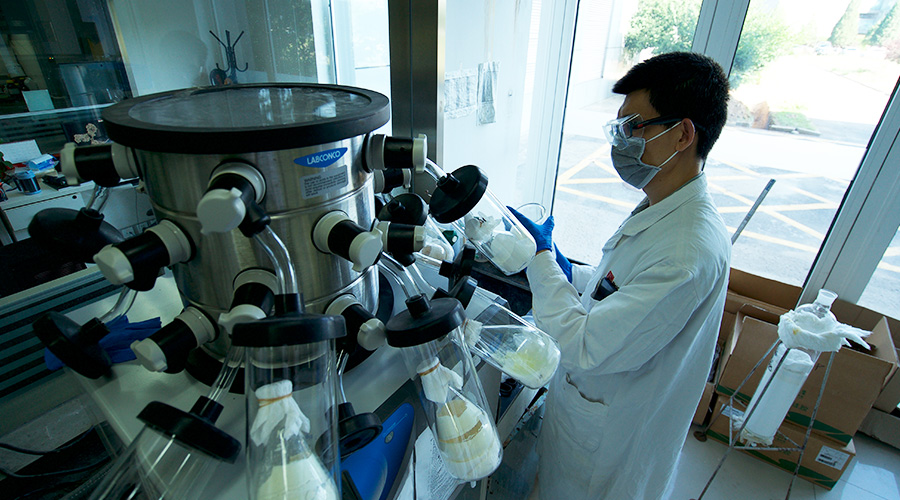

(Photo: Greg Vote | Getty Images)

The world today is coloured by uncertainty and disruptions on various fronts. Nations are grappling with political and social pressures. There are seemingly difficult tradeoffs between pursuing economic prosperity for their voters and conserving a more liveable environment for their citizens and those yet unborn.

It is easy to focus on the now, and to steer towards decisions that help to maximise short term profits and satisfy short term demands.

Temasek holds a very different perspective.

As a generational investor, we look far beyond the present, think deeply about the value we can bring to our investee companies and wider communities, and act with conviction to make a lasting impact well beyond the present generation.

The 17 United Nations Sustainable Development Goals (SDGs) lay out the path to a better and more inclusive world of hope and opportunities by 2030.

While the SDGs are challenging to achieve, they offer significant opportunities. Business and Sustainable Development Commission’s report in 2017 identified over US$12 trillion worth of business opportunities over the next decade in areas that support the SDGs, such as food, healthcare, energy and materials.

Be it opportunities presented by pursuing more sustainable growth, or risk mitigation to cool the Earth, or even simply finding more efficient use of resources to feed and support the growing population globally, now is the time to act, and deliver a more sustainable future together.

Creating solutions for sustainable living

The Earth is being pushed beyond its limits to support the needs of a growing population.

There is an urgent need for solutions that support sustainable, longer and fulfilling lives, while ensuring that the natural environment is protected.

“Achieving a sustainable future requires the collective effort of the global community”, said Robin Hu, Head of our Sustainability & Stewardship Group. “We need capital, policy, civic society, and discerning and demanding consumers working together”, he added.

Many of our longstanding portfolio companies are already doing their part.

For example, to meet the growing need for green energy solutions, Sembcorp Industries has invested in wind and solar assets across Singapore, China and India. To ensure a sustainable supply of clean water, Sembcorp Industries and Keppel Corporation have developed desalination and wastewater treatment projects around the world. Meanwhile, Olam continues to promote sustainable farming practices, which protect the environment and empower smallholder farmers through economic inclusion.

We have also invested in companies developing solutions for the sustainable supply of food, energy, water and materials. Some of these include: Neoen, an international solar, wind and energy storage company; Pivot Bio, a synthetic biology company producing nitrogen-fixing microbes that reduce the need for chemical fertilisers; and indoor farm operators like Singapore-based Sustenir Agriculture and US-based Bowery Farming, that grow high quality fresh produce in urban spaces using far fewer resources.

Supporting longer lifespans

An ageing population presents a number of challenges and opportunities around the world.

We have identified specific needs of seniors such as financial and retirement planning, travel and wellness, healthcare, and retirement housing as potential areas for investment.

We have invested in companies that are seeking to develop new therapies for ageing-related diseases such as cancer and neurodegenerative conditions, as well as companies providing high quality healthcare services.

These include: BeiGene, a China-based company which develops novel therapies for cancer; Denali, a company based in the US which comes up with disease-modifying therapies for neurodegenerative diseases; Iora Health, which provides value-based healthcare solutions to seniors; and Sheares Healthcare, a pan-Asian healthcare services platform headquartered in Singapore.

Key investments in other parts of our portfolio are also expected to benefit from evolving consumption patterns that arise from longer lifespans. Examples of these include AIA, Ping An and Prudential Plc, companies that address long term insurance and protection needs tailored to longer life expectancies in Asia Pacific, the UK and US.