Group Balance Sheets

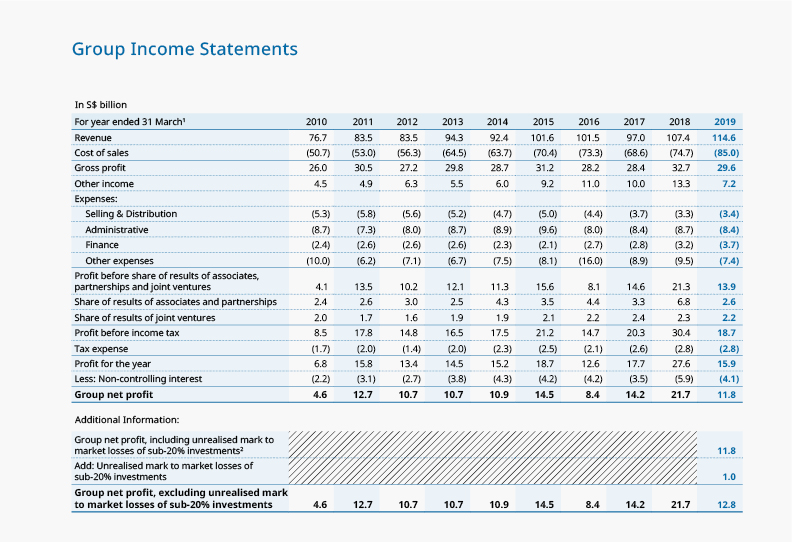

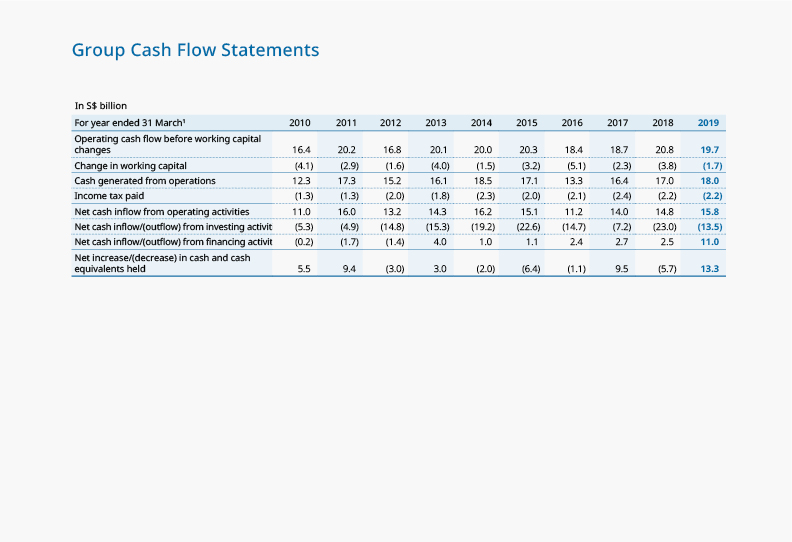

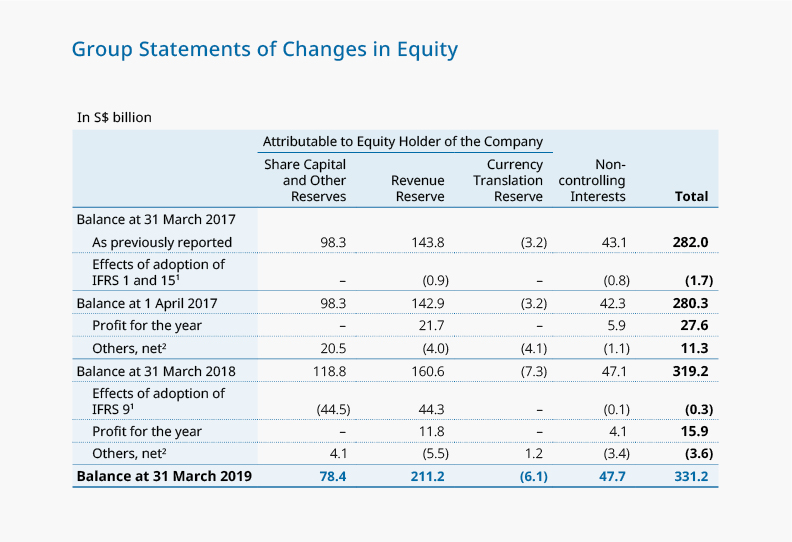

Temasek adopted the International Financial Reporting Standards (IFRS) last year. This includes the new IFRS 9: Financial Instruments standard, which impacts how we report the accounting profits or losses in our group financials. You can find out more information here.

| (From 2002 to 2019) | In S$ billion |

|---|

|

As at 31 March

On 1 April 2018, the Group adopted International Financial Reporting Standards (IFRS). The Group also adopted new and amended IFRS and Interpretations of IFRS that were mandatory for application for the financial year ended 31 March 2019, which included IFRS 1: First-time adoption of IFRS, IFRS 9: Financial Instruments and IFRS 15: Revenue from Contracts with Customers. Changes in accounting policies as a result of IFRS 1 and IFRS 15 were applied retrospectively to the Group financial statements for the year ended 31 March 2018. The effects of adoption of IFRS 9 were recognised in the shareholder equity as at 1 April 2018. Comparative financial statements for the years ended 31 March 2002 to 2017 were prepared based on Singapore Financial Reporting Standards. |

|---|

|

Shareholder equity excluding cumulative mark to market gains of sub-20% investments |

|

Cumulative

mark to market gains of sub-20% investments |

| Shareholder equity |

| Non-controlling interests |

| Property, plant and equipment |

| Intangibles |

| Biological assets |

| Investments in associates, partnerships and joint ventures |

| Financial assets |

| Investment properties |

| Deferred tax assets |

| Other non-current assets |

|

Net current assets/ (liabilities) |

| Current assets |

| Current liabilities |

| Non-current liabilities |

|

Net debt |

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 54.5 | 54.5 | 64.5 | 70.9 | 83.6 | 92.9 | 120.2 | 119.9 | 127.8 | 134.6 | 146.4 | 156.0 | 172.5 | 188.0 | 198.2 | 210.7 | 227.4 | 246.3 |

| – | – | – | – | 7.0 | 21.1 | 23.9 | (1.5) | 21.9 | 20.9 | 11.8 | 13.2 | 14.9 | 30.6 | 19.9 | 28.2 | 44.7 | 37.2 |

| 54.5 | 54.5 | 64.5 | 70.9 | 90.6 | 114.0 | 144.1 | 118.4 | 149.7 | 155.5 | 158.2 | 169.2 | 187.4 | 218.6 | 218.1 | 238.9 | 272.1 | 283.5 |

| 18.5 | 19.2 | 23.9 | 25.3 | 25.4 | 24.4 | 25.7 | 22.6 | 23.5 | 24.0 | 23.5 | 35.2 | 34.8 | 37.8 | 40.6 | 43.1 | 47.1 | 47.7 |

| 73.0 | 73.7 | 88.4 | 96.2 | 116.0 | 138.4 | 169.8 | 141.0 | 173.2 | 179.5 | 181.7 | 204.4 | 222.2 | 256.4 | 258.7 | 282.0 | 319.2 | 331.2 |

| 59.0 | 57.0 | 61.6 | 69.3 | 65.6 | 65.5 | 75.3 | 68.2 | 68.0 | 66.8 | 67.8 | 73.8 | 59.5 | 67.5 | 69.9 | 70.8 | 73.2 | 78.5 |

| 13.0 | 12.7 | 13.5 | 14.7 | 14.5 | 14.8 | 21.4 | 19.9 | 19.1 | 18.9 | 17.9 | 18.2 | 16.4 | 20.0 | 20.5 | 22.6 | 27.9 | 27.7 |

| – | – | – | – | – | – | – | – | – | – | – | – | – | 1.3 | 1.4 | 0.5 | 0.5 | 0.5 |

| 9.9 | 12.0 | 15.7 | 17.0 | 27.1 | 35.0 | 39.5 | 41.1 | 44.6 | 42.1 | 49.5 | 50.3 | 56.7 | 70.2 | 80.1 | 83.5 | 84.8 | 85.0 |

| 6.7 | 5.7 | 11.7 | 13.8 | 27.5 | 52.3 | 73.9 | 40.2 | 64.2 | 65.3 | 60.7 | 70.3 | 81.4 | 101.3 | 88.4 | 98.3 | 132.0 | 134.0 |

| 10.0 | 8.5 | 8.6 | 8.3 | 2.3 | 3.8 | 5.6 | 6.1 | 6.7 | 7.3 | 8.3 | 19.9 | 22.4 | 25.5 | 36.3 | 40.0 | 46.3 | 56.3 |

| 0.9 | 1.5 | 1.6 | 2.1 | 1.7 | 1.6 | 1.8 | 2.0 | 1.8 | 1.7 | 1.5 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.0 | 0.8 |

| 2.8 | 3.0 | 6.5 | 8.3 | 10.0 | 10.4 | 9.4 | 9.5 | 10.2 | 11.3 | 10.7 | 12.4 | 10.9 | 13.0 | 13.1 | 12.8 | 11.8 | 7.4 |

| 12.0 | 9.7 | 15.8 | 14.7 | 12.6 | 8.4 | (3.1) | 11.8 | 22.0 | 27.6 | 32.8 | 34.0 | 35.9 | 31.8 | 31.5 | 41.3 | 38.2 | 44.0 |

| 44.1 | 39.5 | 61.6 | 65.6 | 65.0 | 59.0 | 68.6 | 60.9 | 70.2 | 84.5 | 86.2 | 95.2 | 95.3 | 105.6 | 104.7 | 117.7 | 113.1 | 118.8 |

| (32.1) | (29.8) | (45.8) | (50.9) | (52.4) | (50.6) | (71.7) | (49.1) | (48.2) | (56.9) | (53.4) | (61.2) | (59.4) | (73.8) | (73.2) | (76.4) | (74.9) | (74.8) |

| 114.3 | 110.1 | 135.0 | 148.2 | 161.3 | 191.8 | 223.8 | 198.8 | 236.6 | 241.0 | 249.2 | 280.3 | 284.6 | 332.0 | 342.6 | 371.2 | 415.7 | 434.2 |

| (41.3) | (36.4) | (46.6) | (52.0) | (45.3) | (53.4) | (54.0) | (57.8) | (63.4) | (61.5) | (67.5) | (75.9) | (62.4) | (75.6) | (83.9) | (89.2) | (96.5) | (103.0) |

| 73.0 | 73.7 | 88.4 | 96.2 | 116.0 | 138.4 | 169.8 | 141.0 | 173.2 | 179.5 | 181.7 | 204.4 | 222.2 | 256.4 | 258.7 | 282.0 | 319.2 | 331.2 |

| 22.3 | 22.1 | 21.9 | 26.9 | 16.7 | 23.6 | 33.8 | 22.1 | 17.8 | 9.5 | 16.1 | 19.6 | 9.0 | 32.6 | 44.4 | 39.3 | 49.7 | 51.9 |